The Algerian stock market is a spot market where the buyer must immediately disburse the corresponding purchase order sums and the seller must have securities that match the sales order that was transferred.

After the session’s closure, the SGBV publishes the results of the trading session at its floor, on television and on its website to inform the public.

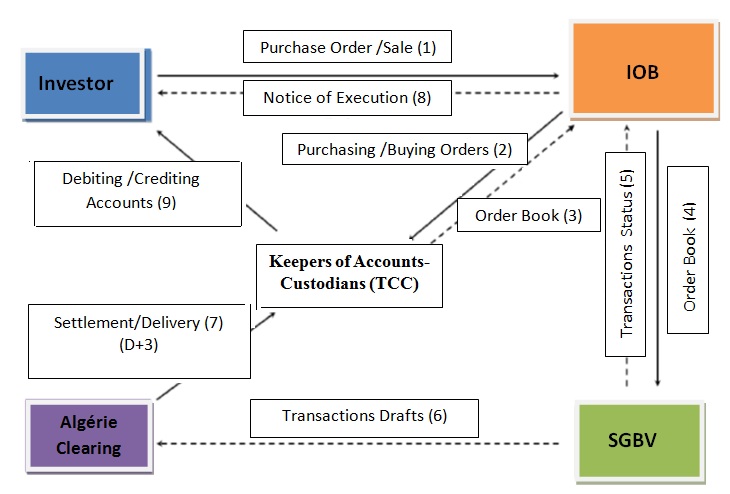

After the execution of the order, the transfer of the sold securities and the settlement of the purchased securities is carried out. Both operations are performed simultaneously by the System of Algerie Clearing to at D+3 days for transferable securities and D+1 for OAT’s securities.

Since the establishment of Algerie Clearing, securities are dematerialized. They are recorded in securities accounts and managed by Keepers of Accounts-Custodians (TCC).

It is worth pointing out that BIO must ensure that the ordering party has the securities or funds to cover the operation he wants to performs. In case of non-delivery of securities within the set timeframe, the BIO is declared in default. SGBV may, in this case, repurchase securities in default of delivery on the market.

The acquisition and / or sale of securities on the stock market can be represented as follows :

Follow us on